Contents:

No, It is not mandatory to link the bank account in order to register the investment of the owner in QuickBooks. If no bank account is linked, then it is not mandatory to record the particular investment. In such a scenario, you can just categorize the particular transaction. It is possible to add other equity accounts in the form of sub-accounts in the main equity account. QuickBooks registers owner contributions in the QuickBooks Desktop Version.

Sam Bankman-Fried pleads not guilty in FTX case – The Guardian

Sam Bankman-Fried pleads not guilty in FTX case.

Posted: Tue, 03 Jan 2023 08:00:00 GMT [source]

This feature allows you to share bills, payments, information, and much more. When you are registering the capital of the owner, you can utilize a special account, which is known as the Owner’s equity account to monitor all concerning transactions. If any of these transactions are paid by company credit card, they can also be entered the same way. Now, you can see this transaction in your check register. If you would prefer to watch our step-by-step tutorial, please click here. Since you’ve already added the owner as a vendor and set up an equity account, what’s left is to record the owner’s contribution.

What is Owner’s Capital in QuickBooks?

I think you are chart of accounts example that any distributions go first to Retained Earnings . Is there any reg that says APIC can’t be paid back to a 100% S Corp shareholder? Is the expectation that if there is a reduction in APIC that there is a deemed sale of stock to the shareholder? I don’t want the reduction in APIC to cause an IRS red flag in the future. If he is going to be paying himself back as soon as possible, that sure sounds like a loan and not equity to me. Ask questions, get answers, and join our large community of tax professionals.

Type your own name or the name of the co-owner who is making the investment in the “Detail” area. On the second line, selectPartner’s equityorOwner’s equity. You’ve got me if you have an additional concern about QuickBooks.

How to Set up Owners Equity Account in QuickBooks Online?

You don’t need to add detail type in QuickBooks Desktop Pro, you can add this or enter on the Account Name or Description. Now, finally, enter the amount of the equity in the required column. This amount is a certain pile of money that business organizations use to maintain their treasury.

- Sub account under Owner’s Equity called Owner’s Draws.

- Now, in this particular account, you cannot record the owner’s contribution.

- From reading this I know I am doing the correct recording.

- From the Account▼ drop-down menu, select the bank account you’re depositing the money into.

You can also check this link to learn more aboutdifferent types of owner’s equity. Partner distribution means you are moving last year’s retained earnings to each partner’s equity account. On the other hand, Owner Draw is an equity-type account used when you take funds and put money in the business.

Frequently Asked Questions

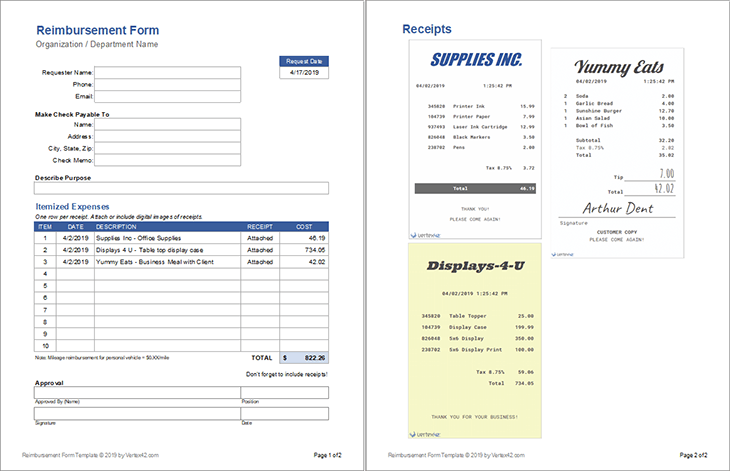

In order to register the cash contribution of the owner, you can select from two separate options. You can Create the Bank Deposits or navigate to the Chart of Accounts. The business is currently a single-member LLC, but I want to design the COA to be somewhat flexible for future potential growth. So I’d like to create a sub-account with my name on it rather than just using the generic names. That way it’s easier to see who has what equity amounts. Again, you do not post anything directly to the top-level account, but only to the sub-accounts.

Sub account under Owner’s Equity called Owner’s Draws. Sub account underOwner’s Equity called Owner’s Capital. Find out how to upgrade your subscription, manage your password, view account fees, request a refund, and much more on our account management page. But in your situation since you are in the stages of monthly contributions from members how you have them set up as customers to receive their contributions is absolutely fine. From the Detail Type ▼ dropdown, select Owner’s Equity or Partner’s Equity depending on your situation.

This interface of QuickBooks is very easy to follow and you are led with the help of prompts as well. In case, you still need help at any time, you can always give us a call, who are renowned experts of this financial accounting platform. Backed with in depth knowledge of our personnel, we can offer you the experts and you can rest assured for all the finance related calculations.

- Now, finally, enter the amount of the equity in the required column.

- Type your own name or the name of the co-owner who is making the investment in the “Detail” area.

- Part of being an owner and running a business includes spending your own hard earned dollars.

- After you set up a deduction or contribution for one employee, you can assign it to other employees.

All you need to do is create an equity account and then you add the cash provided to the particular equity account. In simple terms, the owner’s capital comprises the profits, investment, Retained Earnings, and other additional funds that are related to the owner of the company. Once you’ve set up your owner or partner as a vendor, you’ll need to set up their owner or partner equity account. These accounts let you see what someone invests in and draws from a business.

Before you can record a capital investment, you need to set up an equity account. Click to select the company bank account in which you want to deposit the investment in the “Make Deposits” window. What if i keep making additional contributions?

Alternatively, click the “Cancel” button to deposit only the investment check. Skip this step if the Payments to Deposit window doesn’t open. Then, as my last post addresses, when the company pays back the APIC, it will be reported as reducing APIC and basis. You can use the Direct Connect Option by enrolling for the Direct Connect service which will allow you access to the small business online banking option at bankofamerica.com.

New Law Boosts Catch-Up Retirement Contributions – CPAPracticeAdvisor.com

New Law Boosts Catch-Up Retirement Contributions.

Posted: Tue, 31 Jan 2023 08:00:00 GMT [source]

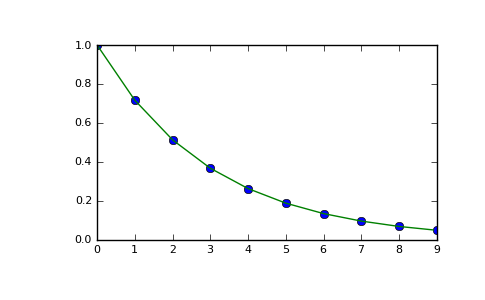

It entails the net income since the business began. Owner’s equity is viewed as a continuing claim on the assets of business. It will also decrease if you have expenses and losses in the business. In general terms, it is considered to be the asset of business which excludes any loss or expenses. The number of investments the company fetches gets calculated and how much each investor withdraws from the equity funds is also the part of it. I want to check to see if any of you know a way to handle this that will give the taxpayer basis and show the additional contributions in equity.

The starting balances for other Balance Sheet accounts that are created in the Add New Account dialogue box. I can’t find anything that seems to address this situation. Research on APIC seems to indicate that distributions don’t reduce APIC but can only be reported against RE. So he can take future distributions in excess of retained earnings against APIC? I thought distributions could not be reported against APIC and could only be reported against RE.

If you wish to have adistribution account in your Chart of Accounts, you can set up one. I suggest also consulting an accountant for further guidance on what account and detail types to use. This is to ensure that your books are accurate. In some cases, your accountant may recommend that you record the purchase as a loan, which uses a liability account. If the owner wants to be reimbursed immediately, simply write them a check.

Learn how to set up accounts to track money that your partners or owners invest in or draw from a business. From theAccountdrop-down menu, select the bank account you’re depositing the money into. Once done, you can create a check and use the owner’s equity account to record the payment. From the Account▼ drop-down menu, select the bank account you’re depositing the money into. Select “Make Deposits” from the drop-down menu. If QuickBooks displays the “Payments to Deposit” window, click to select the payment and the investment check that you want to deposit and then click the “OK” button.

Black business: Rutherford County entrepreneurs create ongoing … – Daily News Journal

Black business: Rutherford County entrepreneurs create ongoing ….

Posted: Tue, 28 Feb 2023 08:00:00 GMT [source]

Ask questions, get answers, and join our large community of QuickBooks users. Adrian Grahams began writing professionally in 1989 after training as a newspaper reporter. His work has been published online and in various newspapers, including “The Cornish Times” and “The Sunday Independent.” Grahams specializes in technology and communications. He holds a Bachelor of Science, postgraduate diplomas in journalism and website design and is studying for an MBA.